additional commentary by Rep. Timothy Horrigan; January 14, 2014 & February 19, 2014

This bill is an amalgam of multiple bills which were introduced in 2013. I was the cosponsor of HB 501, which simply raised the minimum wage to $8.25/hour and a cosponsor of HB 127, which raised it only to $8.00 but then indexed it for inflation. One bill made it as far as the Senate, in severly attenuated form, and there it died:

|

HB 1403-FN – AS INTRODUCED 2014 SESSION 14-2449 06/05 HOUSE BILL 1403-FN AN ACT establishing a state minimum hourly wage. SPONSORS: Rep. Kelly, Merr 20; Rep. Muns, Rock 21; Rep. Horrigan, Straf 6; Rep. Knowles, Hills 37; Sen. Larsen, Dist 15; Sen. Lasky, Dist 13 COMMITTEE: Labor, Industrial and Rehabilitative Services ANALYSIS This bill establishes a state minimum hourly wage to be adjusted by the cost of living index.

|

|

Explanation: Matter added to current law appears in bold italics. Matter removed from

current law appears [ Matter which is either (a) all new or (b) repealed and reenacted appears in regular type. 14-2449 06/05 STATE OF NEW HAMPSHIRE In the Year of Our Lord Two Thousand Fourteen AN ACT establishing a state minimum hourly wage. Be it Enacted by the Senate and House of Representatives in General Court convened: 1 Minimum Hourly Rate. Amend the introductory paragraph of RSA 279:21 to read as follows: 279:21 Minimum Hourly Rate. Unless otherwise provided by statute, no person, firm, or corporation shall employ any employee at an hourly rate lower than $8.25 or that set forth in the federal minimum wage law, as amended. Tipped employees of a restaurant, hotel, motel, inn or cabin, who customarily and regularly receive more than $30 a month in tips directly from the customers will receive a base rate from the employer of not less than 45 percent of the applicable minimum wage. If an employee shows to the satisfaction of the commissioner that the actual amount of wages received at the end of each pay period did not equal the minimum wage for all hours worked, the employer shall pay the employee the difference to guarantee the applicable minimum wage. The limitations imposed hereby shall be subject to the following exceptions: 2 Minimum Hourly Rate. Amend the introductory paragraph of RSA 279:21 to read as follows: 279:21 Minimum Hourly Rate. Unless otherwise provided by statute, no person, firm, or corporation shall employ any employee at an hourly rate lower than $9.00 or that set forth in the federal minimum wage law, as amended. Beginning in September 2016 and each September thereafter, the commissioner shall adjust the minimum hourly rate then in effect based upon the increase in the cost of living. The increase in the cost of living shall be calculated using the 12-month percentage increase, if any, in the Consumer Price Index for all Urban Consumers, U.S. city average, all items or its successor index as published by the Bureau of Labor Statistics of the United States Department of Labor, for the most recent 12-month period for which data is available at the time that the calculation is made. The commissioner shall round the adjusted minimum hourly rate to the nearest multiple of 5 cents and announce it by October 1 of each year and it shall become effective on January 1 of the following year. Tipped employees of a restaurant, hotel, motel, inn or cabin, who customarily and regularly receive more than $30 a month in tips directly from the customers will receive a base rate from the employer of not less than 45 percent of the applicable minimum wage. If an employee shows to the satisfaction of the commissioner that the actual amount of wages received at the end of each pay period did not equal the minimum wage for all hours worked, the employer shall pay the employee the difference to guarantee the applicable minimum wage. The limitations imposed hereby shall be subject to the following exceptions: 3 Effective Date. I. Section 2 of this act shall take effect January 1, 2016. II. The remainder of this act shall take effect January 1, 2015. |

|

LBAO HB 1403-FN - FISCAL NOTE AN ACT establishing a state minimum hourly wage. FISCAL IMPACT: The New Hampshire Municipal Association states this bill, as introduced, may increase local expenditures by an indeterminable amount in FY 2015 and each year thereafter. The New Hampshire Association of Counties states this bill may increase county expenditures by an indeterminable amount in FY 2016 and each year thereafter. There is no impact on state expenditures, or state, county and local revenue. METHODOLOGY: The New Hampshire Municipal Association states this bill increases the minimum wage to $8.25 an hour on January 1, 2015 and to $9.00 an hour on January 1, 2016. The Association states to the extent municipalities are paying an hourly wage of less than $8.25 on January 1, 2015 or less than $9.00 an hour on January 1, 2016, local expenditures would increase. Based on information available to the Association, few municipal employees have wages below the specified amount. The Association does indicate any increase in expenditures would be minimal. There is no impact on municipal revenue. The New Hampshire Association of Counties states this bill will have no fiscal impact in FY 2015 as the hourly wages paid to county employees exceeds the $8.25 an hour minimum but may have an impact in FY 2016 as not all county employee hourly wages may exceed the $9.00 an hour minimum. The Department of Administrative Services states this bill will have no impact on the state as the current minimum wage exceeds the amounts contained in the bill. The Department of Labor states this bill will have no fiscal impact on the Department as it already has the systems in place to meet the requirements of this bill. |

And, here is some written testimony I prepared for the February 11, 2014 public hearing. I also gave some oral testimony:

Testimony for House Bill 1403"AN ACT establishing a state minimum hourly wage."

Rep. Timothy Horrigan (Strafford 6); February 11, 2014 |

|

The bill before you today

raises the state minimum wage to $8.25/hour in 2015, going

up to $9.00 in 2016, with indexing for inflation. If

this bill passes, full-time minimum-wage employees

would still be unable to support a family at the poverty

level. But, $9.00/hour is still a significant step

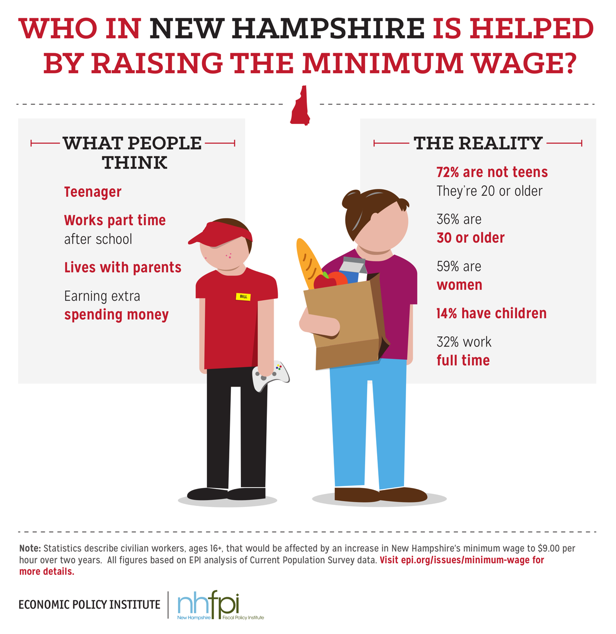

up from the current rate of $7.25/hour. Only a small percentage of minimum wage workers are teenagers working part time: it is about 15%, Even those young workers deserve a living wage and in fact most of them are members of families with below-average incomes— often, far below average. I favor raising the minimum wage for these three reasons:

The minimum wage has dropped in real value over the years, even as the wages of top executives have skyrocketed. The same people who predict gloom and doom when low-level wages go up slightly never seem to worry about high-level wages, even though it is not uncommon for a "C Level" executive to make as much money as thousands of his subordinates. Just to name one absurd but not unique example, JC Penney (which happens to anchor a regional mall in the next town over from Durham) paid its new CEO Ronald B. Johnson (who they lured over at a 9-digit cost from Apple's retail division) and five other top executives $190 million in 2011. Johnson and most of the others were fired in 2012 and 2013. A few weeks ago, the current CEO Myron Ullman announced that he would close 33 stores and eliminate 20,000 jobs. The savings from that round of downsizing, which will destroy 20,000 jobs and eliminate an anchor of 33 shopping districts, was just $65 million, about what Johnson and his friends made in four months. The modest rise in the minimum wage proposed by this bill would go a long way to restoring a measure of sanity and fairness to the relationship between our corporate sector and our work force. |

See Also:

NH Fiscal Policy Institute materials: